The Week at Unified

By: Virginie Boone

Around the time you might be reading this, the State of the Industry will be happening live at this year’s Unified Wine & Grape Symposium, a 2.5-hour overview and discussion of what’s being planted to what’s selling.

The participants will be Mike Veseth of The Wine Economist, Jeff Bitter of Allied Grape Growers, Danny Brager of Azur Associates, Steve Fredricks of Turrentine Brokerage and Wine Market Council’s Liz Thach.

A year ago, 10,000 people attended Unified, and many took in the State of the Industry then. Veseth took notes, and these were his observations at the time:

- White is the new red. Stable sales are the new growth. Wine sales are down in terms of both volume and value. The number of wineries in the U.S. actually fell. Most of the decrease was in the category of “virtual wineries,” which sell wine that is actually made by other companies under contract.

- Tough times for the nurseries that supply grape plants. One vendor said that if the best year was 100, the current status is about 20. Vineyard acreage in California and elsewhere continues to fall, with more removals to come.

- Producers are opting for lower-weight bottles and looking to source them domestically. Shipping costs and schedules – and their uncertainties – are big factors.

- Many restaurants highlight their locavore credentials. Farm to table, locally sourced meat and produce, think global, eat local. But how many feature local wines?

Other feedback concluded that the underlying theme at Unified was that being flat was the new up, and that consumers weren’t quitting wine, just drinking it less often, because most wine brands weren’t giving them a compelling reason to stay engaged, but brands that stood for something were winning. Demand wasn’t the problem, differentiation was.

Another takeaway from last year was that the white wine boom isn’t random – white wines are sessionable and perceived to be healthier.

This year, it’ll be interesting to see if the analysis is the same. White wines? Yes, probably still doing well. Brands standing for something winning? Also most likely better resonating with consumers. Restaurants needing to highlight their locavore credentials with wine as much as the menu? Would be nice.

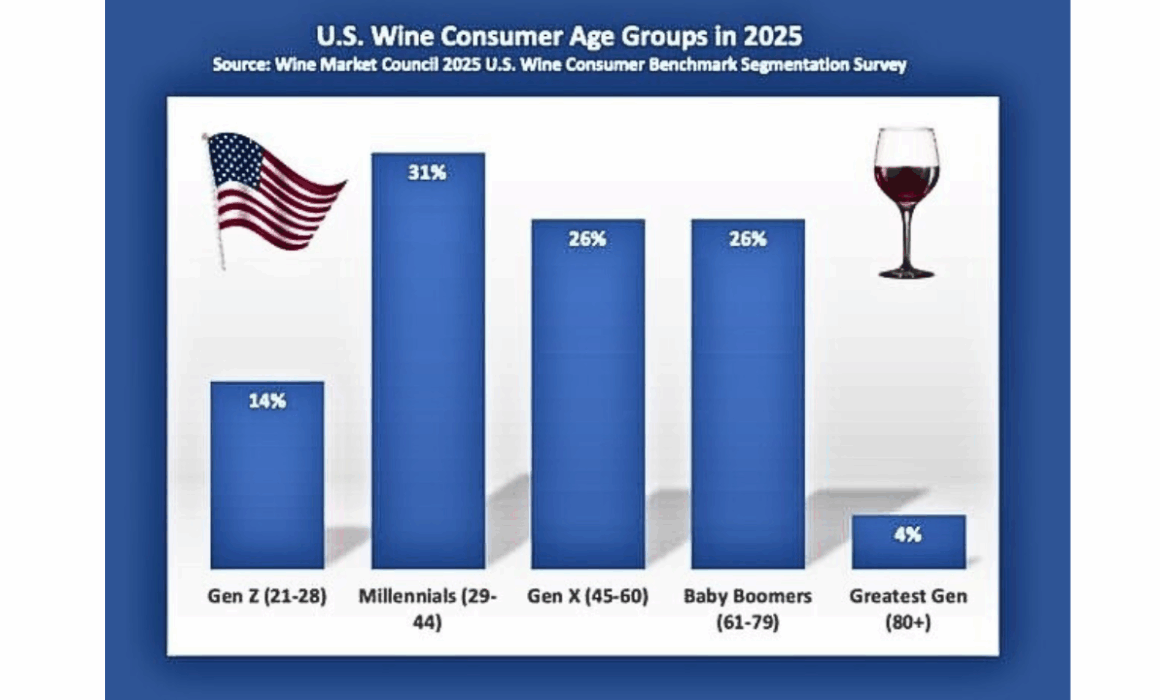

Continuing with data that impacts action, Wine Market Council conducted a 2025 U.S. Wine Consumer Benchmark Segmentation Survey last year that revealed a major shift in the U.S. wine-drinking landscape, finding that Millennials had officially overtaken Baby Boomers as the largest group of wine consumers.

The 2025 sample included 5,000 U.S. adults of drinking age and concluded that 31% of American wine drinkers are now Millennials, followed by Baby Boomers at 26%, whose share had dropped from 32% in 2023.

Gen Z had climbed from 9% to 14% though only half of that group is even of legal drinking age. Ultimately, the largest erosion was in Baby Boomers, who are consumers over 60 years old.

But the study also found that the percentages of non-Hispanic White, Black and Asian Americans drinking wine was up, as was the number of men who reported drinking wine.

The study also unearthed that among the most important message the wine industry needs to hone is correcting the misperceptions that wine has high sugar or unnecessary additives. This continues to be a bugaboo with unsavvy consumers.

Tomorrow, Thursday January 29, aims to add to the dialogue through “The Path Forward: A Conversation with Chuck Wagner and Industry Leaders Across the Value Chain on Rebuilding Demand and Rethinking Wine’s Future.”

As billed, Chuck Wagner of Wagner Family Wines and Caymus Vineyards will talk about today’s wine market with Zachary Poelma, the Senior Vice President of Commercial Intelligence at Southern Glazer’s Wine & Spirits, and Adam Teeter, co-founder of VinePair. A look at the mechanics of moving wine from vineyard to shelf given market pressures and shifting shopper behavior is sure to be a lively topic full of insights for the year ahead.